“Older women likewise, that they be reverent in behavior, not slanderers, not given to much wine, teachers of good things— that they admonish the young women to love their husbands, to love their children, to be discreet, chaste, homemakers, good, obedient to their own husbands, that the word of God may not be blasphemed.” – Titus 2:3-5

Contents

Introduction: My Story

Module 1: Foundations

- Class 1 – Treat Your Home Like a Business

- Class 2 – Articulate the Problem

- Class 3 – Case Study – Mary

Module 2: Solutions

Module 3: Practical Steps

- Class 1 – Single-Use Items

- Class 2 – Optimise Your Pantry

- Class 3 – Inventory

- Class 4 – Strategise Like a Pro

Module 4: Build Your Food Budget

Appendices

Why Master the Home? My Story

The Problem

Imagine being a young stay-at-home mother in a foreign country with a 1-year-old baby.

Your husband has just lost his job, you then lose your home and you have absolutely no substantial savings to help you.

Imagine the panic once the realisation sinks in that you and your young family are now homeless.

Imagine the stress of trying to figure out how to get back to your native country to get help from your family with all of your possessions (because you won’t be able to afford to replace them) and very little money.

To compound the difficulty, your native country is about to enter an accommodation crisis whereby housing has become incredibly competitive and expensive.

How, you ask, did you allow yourself and your family to get into this situation in the first place?

Would you instantly regret the poor financial choices and the sheer ignorance and naivety that led you to this desperate circumstance?

You would, and so did I almost five years ago when this happened to me and my family.

This was the circumstance that led my husband and me on the hard road to learning about food, finances and the importance of Mastering the Home.

The Realisation

My husband and I had to undergo some serious self-reflection in order to understand how we shared in being responsible for allowing for this to happen.

We were careless with our finances. While we weren’t splurging at every paycheck, we still had no coaching with what to do with our money once that paycheck came in.

We lived in the moment. We didn’t seriously plan together what our goals were for the future.

We naively believed that my husband’s job was secure.

We didn’t invest our money into savings accounts for emergencies and our financial goals.

I certainly had no idea of how to manage or budget for food and didn’t realise how impactful food was to our finances.

Literally the Worst

I then thought about my own role as a full-time homemaker.

I came to realise that though I valued my job, I had absolutely no idea how to do it properly.

I got married young. I was not naturally a person that was good at cleaning or organisation. I believed that these skills were inherent and not learned, and because of that, I had accepted that I would simply never be an organised or skilled homemaker.

Not only that, I was too sensitive to what society was telling me about my role– that being a dedicated homemaker was an archaic, oppressive job for lazy, unintelligent, uneducated, unskilled, and unambitious women.

I lacked the confidence needed to carry out my role with conviction.

This had negatively impacted my household and my household’s finances because, as I later discovered, there is a link between every area or department of my household, much like there is within a business.

Not optimising these areas within my home was not only putting me under pressure and inconveniencing my family, but it was also putting a strain on my resources and therefore impacting the cost of running my home.

I knew something needed to change, but how? I was literally the worst homemaker I knew. Organisation and tidiness were two traits I simply did not possess. Not only that, I was too exhausted to be the homemaker I wanted to be. Could I change?

My Journey

Through hard research, learning and reflection, I started to develop a picture of what being a homemaker is, and began the journey towards rediscovering the art of good homemaking. I sent myself on a training course.

I could see that homemaking is a profession in its own right and that my home is my business. Its growth and flourishing depended on my hard work and skill.

It requires every ounce of intelligence, organisation, creativity, diligence and skill that I have to offer.

If I can’t naturally offer what was required, I can always study and learn how to develop and implement those traits, much like with any job.

I developed an ambition to run my household well and look to optimise every department, starting with my household’s finances.

I remembered stories my mother told me of elderly women she cared for and of how these women, even in their advanced age, were very unlike the generation of my time- they were hardy, skilled and diligent women who took hardship on the chin and simply got the work done.

This incited my interest- how did they run their homes well despite not having the abundance of food, the modern appliances or electricity to help them that I enjoy today?

What is the difference between me and them?

Resurgence

A community opened to me of countless homemakers facing the same struggles I was facing. Like me, many of them were looking to the past for answers but didn’t even realise it.

Minimalism? Living the debt-free life? Local and seasonal food? Simple living?

These are things modern homemakers are craving, and these were the exact traits I saw from the homemakers of the past that I was researching.

I knew I was on to something, and this fueled my desire for more.

Mastering the Home

I have learned a thing or two on my journey so far and I am still in the process of Mastering the Home. I believe all homemakers are.

Learn from my mistakes and success.

I have a far better handle on my finances now than I did two years ago. I am going to share with you everything and hold nothing back.

After this guide, you will have laid a foundation in optimising your home and your food budget, and you will save money.

Introduction

Time To Master The Home

Welcome to the beginning of your money-saving journey. By undergoing this training, you are one step closer to Mastering the Home through effective food budgeting than you were yesterday.

Let me quickly explain how this guide is laid out.

There are 4 modules that are broken into classes.

Each class has 3 sections to help you.

They are, Learn, Think and Do.

Learn

This is where you are armed with information.

Try to take in as much as you can in this section. It could be helpful to take notes as you read along.

Think

This is where you are asked challenging questions to reflect on.

This is the bridge between what you have learned and how you can apply it to your life.

Do

This is where you take action and put what you have learned and thought about into practice.

Ask Me A Question

At the bottom of this guide is a comment thread. If you need to ask questions or share some insights this is the place to do it. You can tag me in the comment by typing “@scary-sary”.

The comments are also a neat place to meet other like-minded homemakers and build some friendships!

Without further delay, let’s do this!

Module 1: Foundations

In order to build confidence in how you can save money through your future optimized food budget, you need to think deeply about why you’re doing what you’re doing so you have the conviction to push through to the end.

In this Module called “Foundations”, you’re going to get philosophical and start thinking at a foundational level about why you spend money the way you do.

Class 1 – Treat Your Home Like a Business

Learn

I have a firmly held belief that the home is a business.

If you want an optimised household that is ticking over and saving money, you need to run it like a successful business is run.

Let’s explore how the home is like a business.

The Home

The home is a system of different departments that must all operate optimally and complementary to each other for the overall holistic health and purpose of that household, which ultimately is to serve the family and to assist the family in achieving their financial goals.

Some departments of the household include finances, food, cleaning and maintenance, laundry, entertainment and the inventory within the household.

In order for your home to run well, each department needs to be broken down and organised so that the household can operate efficiently.

A Business

Any business functions optimally when all departments work in unison to achieve the business’ goals, one of which is to make profits.

There are many departments within a business and a household that are held in common- like finances, inventory, and cleaning and maintenance.

Good businesses make sure that all departments from the lesser to the greatest are operating as efficiently as possible because if one department is struggling, it will negatively impact the overall health of the business.

Which department is the most important department within a business?

The financial department, because if that area isn’t functioning well it will lead to the failure of the business. Any good business has a solid grip on its finances and knows exactly what is coming in and out and when.

Not only that, any good business has clearly articulated and planned goals and strategies for how the business can continue to grow, and for how it can use, invest and gain profits.

Treat Your Home Like a Business

Every family has future goals and needs, and money is most likely the way to achieve them.

This means that like a business you need to have a solid grip on your financial department and know your household’s incomings and outgoings inside and out.

You should also have clearly articulated and planned goals and strategies for how to maintain your household and for how your household uses and gains profits.

Commit to run your household like a business.

While all departments within the household affect your finances in some way, food budgeting and good food management are two of the most impactful ways you can benefit your household’s finances, and you’ll explore this in greater depth later.

When your home is optimised like a business, you will realise that your home can generate income for your family.

How is this done? Through saving money!

Have you ever heard the saying “a penny saved is a penny earned”?

This means that by reducing your spending by optimising your household finances through food budgeting and good food management, you are making money.

This is one way that you as the homemaker can immediately generate additional income.

Food

How does food impact your finances so much? Food is your second largest expense apart from mortgage or rent payments.

Not only that, food is your largest controllable expense.

Rent or mortgage payments are largely out of your control, as well as many of your utilities, but when it comes to food you can choose exactly how much you spend or waste on it.

Not many households recognise the impact food has on their finances and so buy their groceries without any strategic budget or meal plan to guide their spending.

The average family and newlywed couple tend to run their households aimlessly without a strategy and without having long term goals.

Bad food management and the wasted money through this is a symptom of this issue.

Later on, you’re going to explore these issues in more detail.

The Homemaker

If you are the homemaker within your household, you need to view yourself as managing a business and take interest in all departments of the house, delegating where necessary.

Finances, however, should be the first department to conquer because you’re most likely the one doing most of the spending. When done rightly, you’ll have additional income, or more in savings, for your family to put towards your financial goals.

In business, good employers send their employees on training courses so that they’re competent and are continually upskilling. Homemaking is just as important a job that requires studying, strategy and skill, much like being a good manager.

Due to my lack of skill and knowledge of good homemaking, the first years of marriage was one of the most difficult periods of my life and we suffered financially. This does not have to be the case for you. Please learn from my mistakes so that you can avoid them in your life.

In embarking on this journey to Mastering the Home through Food Budgeting, you’re taking the first steps to change that will set you off on a better path than I was on.

View this guide as your training so you can conquer your finances for the optimisation of your household and to reach your family’s goals.

Think

While you’re getting into the nitty-gritty of the course, reflect on these questions:

- Do you know exactly what amount of money is coming in and going out of your household and when?

- Imagine if a business handled their finances the way you spend money on food. How would that business do?

- If you were employed to manage the financial department of a company like you’re currently managing your household’s finances when it comes to food, would you lose your job?

Do

- Using your bank statements, track all of your incomings and outgoings and record when they come in and out.

- Once you define your total monthly income total the sum.

- Review your outgoings and see if there are any services or expenses that can be canceled.

- Total your monthly outgoings and subtract them from your total monthly income. The difference is your total household “profits”.

Class 2 – Articulate the Problem

Learn

Understanding and articulating what your food spending problems are and how much money you are losing is integral to moving forward with intentional food budgeting that saves money.

You might be surprised by how many problems you’ll read below are directly impacting your finances.

Lack of Training

When pursuing a career, you need to develop skills that add value to people’s lives. These skills are developed through education.

For example, if you want to become an accountant or a chef, you must go to higher education or at least become an apprentice to do so.

A good business regularly trains its employees so they can keep on top of their skills.

Much like the above professions, you need training in order to manage food and finances well.

Homemaking is a job that requires skill which must be learned particularly with finances.

You can’t expect to simply make good financial choices when you become an adult.

For many people, however, they are expected to pick these skills up off the ground or learn the hard way through trial and error, which leads to financial set-backs in the future.

Being well trained in necessary life skills like money and food management before marriage or in any stage of adulthood is a very reasonable and a logical thing to do.

It is irrational to expect to pick these skills up instinctively without suffering financially. There is a lot of common sense behind good homemaking.

Personal responsibility needs to be taken for bad financial choices, however, realise that if you’ve never been trained well to handle these necessary life skills in adulthood, you were bound to make mistakes.

The goal now is to learn from those mistakes and learn from other people’s mistakes.

However, there are many other factors that contribute to bad food spending.

Excess

Our Western culture is an excessive culture with a heavy emphasis on materialism, luxury and indulgence. It is a particular problem when it comes to food.

There are benefits to the enormous variety of food and cuisines that are available to us, but there are also downfalls that are impacting your finances.

A heavy expectation for very flavourful and various meals in the home has developed in our time and clever marketing, cravings and spontaneity has replaced careful planning and budgeting that was practised generations ago when it comes to food.

Modern TV / Internet Food Culture

I love cooking shows just like the next person. However, TV and internet food culture tends to predominantly focus on trendy or complex meals that spread across a wide variety of cuisines that are often expensive or inconvenient to cook.

Many homemakers feel they need to provide various and very flavoursome meals on a day to day basis.

Younger homemakers, in particular, lack a repertoire of meals that help them optimise their time and money while considering health and flavour.

This has led to bad habits and practises that wastes time and money, such as:

- A lack of a thorough meal plan

- Food waste and wasted leftovers

- Pantries, fridges and freezers full of wasteful single-use items (items bought without purpose or without a plan to be used up) and

- Spending large amounts of money on a small amount of food.

I want to help you combat these habits.

If you are interested in some of my money-saving recipes let me know in the comments below, I’d love to help you out.

Food Waste = Wasted Money

Food waste has become an unprecedented problem with large grocery outlets, but it’s also a problem in our homes.

There are many consequences of food waste, but it personally impacts you because you are in essence burning your money when you waste your food. This clearly reinforces that food optimised means more money in the bank.

Food waste is a consequence of poor organisation within the kitchen and with planning and budgeting food. It comes about through:

- Shopping without a budget or meal plan

- Uneaten leftovers

- Single-Use Items or items bought without a meaningful purpose

- A disorganised pantry, fridge and freezer and

- A lack of an organised inventory of food items.

By wasting food, you’re using up your inventory of food that you’ve spent money on far too quickly and you’ll soon have to repurchase, wasting money.

Throughout this guide, you’ll find help with combating all of these issues.

Too Busy

Food waste doesn’t just happen because of overspending, lack of a budget or spending on too-specific and expensive food items.

As mentioned above, it is also because of disorganisation and ignorance as to how harmful food waste is to your finances.

If you’re not organised, you’ll keep wasting your money through bad food management.

Many homemakers recognise they’re spending and wasting too much money on food but don’t know what to do about it.

They are already too busy and overwhelmed with the responsibilities of caring for the home, most of which they feel is out of control. This, combined with a lack of a schedule and without delegating responsibilities, leads many to feel too overburdened to sit down and work out their finances and put together a food budget and food management strategy.

Think

- Were you ever intentionally trained in life skills like finances, budgeting and food management? Why/ why not?

- Who should have taught you these life skills?

- Do you feel overwhelmed by planning meals because there’s too much variety?

- Do you think your meal choices may be unnecessarily impacting your wallet?

- Do you feel like you’re too overburdened to work out your finances?

Do

- Write out a list of three of your family’s favourite meals or the meals that you find the most convenient to make. Now list all the ingredients needed to make these dishes.

- List all your responsibilities at home. Now delegate or remove any unnecessary responsibilities that are hindering your ability to manage the home optimally.

- Write down the name of another homemaker with whom you will share what you are learning in this guide. Doing this will aid your retention of this information and could also help your friend.

Class 3 – Case Study: Mary

The purpose of this Case Study is to widen your understanding and for you to use as a comparison to your modern life.

Let’s explore the world of a housewife in rural Ireland called Mary, a 32 year old woman with 3 children who lives in 1950. She and her husband own a small dairy farm and live in a traditional thatched cottage with no electricity or running water.

“I can always remember my mother saying, “this is heaven, this has to be heaven…because it took the drudgery out of the hard work people had to do.” – Maureen Gavan, Interviewed February 2017.

The Rural Electrification Scheme was a widespread scheme to bring electricity and running water to hundreds of thousands of rural Irish homes that spanned from 1946-1965.

Two of the most documented results were:

- How electricity impacted the Irish agricultural sector, of which Ireland’s economy was so reliant upon, and

- How it impacted the Irish housewife, the one upon which the home and therefore the building blocks of society was so reliant upon.

Learn

Let’s learn about how daily life would have been for the subject of our Case Study; Mary.

While her husband worked on the farm, Mary was responsible for all the domestic work and child rearing for their household, along with lending a hand on the farm when needed.

Since they had no electricity, daylight was vital for all necessary work. On average Ireland only has 7.5 hours of daylight during the winter.

A typical day for Mary would have been to:

- Wake at the crack of dawn

- Light the huge hearth that was necessary for work

- Dust from the dirt caused by the hearth

- Fetch water from the well

- Make porridge with water on the open fire in her cast iron pot

- Fetch more water for washing up.

The other jobs that needed water from the well were:

- Cooking

- Cleaning

- Tending to the small garden for food like onions, potatoes and kale or cabbage

- Caring for small animals and children

- Cup of tea to warm everyone and

- The difficult task of washing all the household clothes, linen and other textiles by hand dirtied through farm work.

Other daily jobs were:

- Baking several loaves of Irish Soda Bread from bulk wheat as a cheap, easy and nutritious way to fill stomachs and stretch meals

- Trading and purchasing food

- Preparing and preserving the food without a refrigerator

- Cleaning up after every meal

- Hanging out the hand-washed laundry and

- Mending clothes by candlelight in the evening.

This work was carried out alongside:

- Caring for small children

- Breastfeeding and/or being pregnant

- Caring for her husband and dependents like elderly parents and

- Working within a timeframe of 7.5 hours of daylight.

In 1958, Mary got electricity and running water through the Rural Electrification Scheme. She bought a cooker and a fridge and got lights and running water.

Mary’s life changed tremendously as her workload intensified during this time with the arrival of more children.

Electricity didn’t solve every hardship, however, as:

- The electricity bill was a new expense to pay

- Households at the time initially received only one or a few sockets at most

- The electrical appliances available are only the bare minimum by modern standards and

- Filthy clothes still need to be washed by hand.

Mary worked hard over the next few years to save her money from selling chicken eggs to get an electric kettle, iron and a washing machine. Slowly, Mary’s burdens were becoming more manageable.

When compared to the drudgery of work prior to electricity, women at the time described their new circumstances as pure luxury.

Another quote from an advertisement at the time reminisced about the hardships of the past prior to electricity:

“It’s only a few steps in this kitchen from fridge to sink, and frying pan to kettle to cooker…modern planning has cut down the distance a housewife has to walk..You know, very often in a day’s work we housewives can walk as far as an All Ireland Forward runs in a football final at Croke Park. But we get no medals for it.” (Source)

All Work and No Play?

While Mary was a skilled and hardworking homemaker, her homemaking experience is not the standard of good homemaking.

Mary should be admired for her diligence, determination and organisation.

However, the severe disadvantage to Mary’s experience was her poor quality of life. Her life was completely consumed with work and homemaking responsibilities. This was why electricity was so desperately needed for the rural Irish housewife.

While the modern homemaker can learn from and implement her skills, a better standard of good homemaking is reached when modern conveniences and freedoms are combined with her skill, hardwork and knowledge.

Electricity, modern appliances, the affordability and accessibility of food and the general improved living conditions of today, when used rightly, are tools in your utility belt to help you do a more efficient job with a purpose.

As a homemaker, you’re not just a cook, cleaner and round-the-clock carer. The goal in home optimisation is to serve your family, yourself and others and to reach your financial goals so that the fruits of your hard work can be thoroughly enjoyed.

This is achieved through a well thought out strategy and an organised schedule. Be purposeful and schedule every hour of your day so you can reach your goals and enjoy your downtime.

Think

Compare and contrast your homemaking experience with Mary’s:

Goals

- Did Mary operate in a goal-orientated framework?

- What short term and long term goals might Mary have had?

- What financial goals did Mary have?

- Do you carry out your daily responsibilities in a goal-orientated framework, including how you spend your finances?

Diligence

- Would you describe Mary as diligent?

- What was her motivation to work so hard?

- Is diligence one of your characteristics?

- Are you prepared to be diligent in saving money on food?

Organisation

- To be organised is to structure things in a systematic way. How did Mary organise her time and money?

- In what ways have you organised your time and money?

- Do you work within a time limit or schedule? Timers and organised schedules are integral to the homemaker for getting work done fast.

Skill and Practicality

- What skills do you think Mary possessed?

- How did she learn them and who did she learn them from?

- What was Mary’s approach to food?

- What skills do you need to acquire to begin Mastering the Home through Food Budgeting?

- Are you willing to develop a practical, simplistic approach towards food in order to save money?

Thankfulness

- How do you think Mary felt post-electricity?

- How would this have impacted her work?

- Have you ever reflected on how privileged you are to have electricity and food that is accessible and affordable?

- How can you use the conveniences and freedoms you enjoy today to optimise your home and food budget?

Do

- List three areas in your life that you lack diligence in. Now list three solutions for how you can remedy them.

- List three areas you plan to improve in being organised within your household.

- List three skills you possess that can be used for effective budgeting.

- List three ways being grateful will help you save money.

- Craft a daily schedule. Divide your day into four categories; Morning, Noon, Afternoon and Evening. Within each category create three columns titled: Time, Responsibility and Action. Under the Responsibility, column proceed to fill your day with necessary tasks that will allow you to run your home optimally. Under the time column set a time limit for each responsibility. Finally in the Action column, form a to-do list of duties that must be done to complete the task within time.

Module 2: Solutions

In this second Module called Solutions, you’ll find simple tips that will help you develop a fresh and frugal outlook on food spending and will explore the importance of your financial goals in effective budgeting that saves you money.

Class 1 – Goal Identifier

Learn

When my husband and I were engaged, we were so focused on the short-term goal of getting married that we had no idea what we were doing or working towards once that had happened.

I hadn’t come to realise that the home is like a business and I needed to start laying the foundation for it to operate well in all departments, but especially with regards to finances.

Our lack of direction led to general disorganisation, poor food management, and wasteful, purposeless spending which set us back from reaching the goals that we now hope to achieve.

Purpose

It is important to acknowledge that we can’t control what ultimately is going to happen in the future. However, our lives don’t function in a vacuum.

If you have responsibilities like a family and a household to run, a purposeful framework within which to operate is needed to handle your responsibilities such as your finances well.

Intentional stewardship of your money has both immediate and long-term benefits, much like bad money management has both an immediate and long-term negative impact.

Homemakers struggle in home organisation and management because of a lack of purpose, direction, mentorship, energy and skill.

Without serious consideration of why household optimisation, budgeting and saving is needed and without the training to do so, households will fail to make good long term spending and saving habits, and the cycle of disorganisation, bad food management and wasted finances will continue.

Importance of Goals

A goal is a clearly articulated and achievable plan for the future that is based on your family’s needs, desires and values. Goals are exceptionally important to everything that we do.

Actions which implement daily steps to change happen because of goal-orientated motives.

Your clearly articulated and achievable goals will guide you in your actions and choices as a family and will carry you through the difficult first steps towards change because you know what you’re heading towards.

Think about successful businesses and how they approach the future. Many households today operate in a go-with-the-motions approach, while any successful business thinks about where it wants to be, and develops strategies and plans for how it can reach these future goals for its growth and continued success.

In most cases, your family’s goals won’t be reached without a radical change in how money is spent and saved. Without careful budgeting and intentional actions, your goals are just fantasies.

Bad Spending Habits

The biggest factor that is within your control with regards to your finances is to learn contentment with what you already possess and to train yourself to live within your means.

Living and thinking this way will train you to handle your money carefully so that you can save it to reach your goals quickly.

In order to achieve these things, bad spending habits which waste your finances and prevent you from reaching your goals need to be addressed, many of which you will have encountered in this guide already.

Examples of bad spending habits with regards to food are:

- Eating out frequently in any form, like takeaway coffee, dining out, multiple takeaways each month, buying convenience food instead of cooking from scratch, etc.

- Not practising purposeful budgeting

- Wasting leftovers

- Buying single-use items

- Lack of a purposeful meal plan and

- Lack of food inventory.

These small things that are within your control are ultimately what impact your wallet the most.

If you can train yourself through a realistic and long-term goal-orientated food budget, you’ll learn to be purposeful with your spending and saving and will develop good spending habits.

We all have days that don’t go our way, and you’ll have times when you’ll still overspend on food and waste it too.

What is important is that you commit to change and are diligent in continually moving on even when you fail.

Without goals, you’ll give in to discouragement. But with your goals, you’ll see how you can easily recuperate and get back on the money-saving wagon.

The Small Things

People can fall into the trap of thinking that saving on the big stuff is what ultimately helps them save money; like a “staycation” instead of going abroad, or buying a second-hand car instead of a new one.

While these things certainly help, the reality is as we’ve seen- that it is through practising self-control in the daily things and our daily spending habits that will save you the most money.

This is why it was so important that in the first Module Foundations we attempted to break down your thoughts towards food spending because it is ultimately this mindset that is impacting your actions, leading to poorly invested finances.

When planning your goals, start off with small achievable goals and be specific, with time limits.

Once you’re reaching these short-term goals, you will gain confidence and motivation to reach your long-term goals.

Short-term goals might include:

- Saving $1000 for an Emergency Fund within the next year starting with $25 a week or more for emergency use only

- Saving $25 a week or more for 3-6 Months Expenses Fund within the next 2 years in case of job loss or the washing machine breaks

- Spend $10 less per person per week in shopping immediately that will go towards savings

- Saving a certain amount each month to pay for a modest wedding within the next two years

- Saving to buy all baby necessities within the next year if you’re planning to start a family in the near future

- Start eating all of your leftovers immediately

- Plan all expenditure purposefully, including luxury items, immediately

- Stop eating out or going on holiday or limit your spending until the Emergency Fund, 3-6 Months Expenses Fund and other priorities are saved for.

Some long-term goals may include:

- Paying off your credit card debt within the next 3-5 years

- Save to build a house within the next 10 years

- Paying off your mortgage within the next 15 years

- Have an inheritance fund saved for your children within the next 20 years

- Have a retirement fund saved by the time you’re 50.

Think

- A good, functioning home that is operating optimally and saving money towards their goals is expected to just happen without any significant thought or effort. Imagine a business operating the way the modern household does, what would be the results?

- Have you ever thought seriously about why your household is functioning the way it is?

- Have you ever sat down with your spouse/spouse-to-be and discussed your values and desires as a family/family-to-be?

- Have you ever seriously planned and discussed your finances and your future with your spouse/to-be-spouse?

- Do you plan to marry, hope to own a house, get out of debt? What other needs are waiting for you in the future that will require savings?

- What bad spending habits do you have that’s wasting your money?

Do

- List three of the most meaningful things you have learnt so far in this guide.

- Think of three things you are really good at. If you were to become the best in the world at these three things what would they be?

- List your top six motivations/values.

- List six things you would do if you had $10 million in your bank account.

- It’s now time to define your six-month goals. They must be specific, achievable and have a time limit. List six goals you hope to achieve in the next six months.

- Now list three goals for the next 90 days (these must be associated with the goals previously listed). Review these goals, they are the reasons why you need to Master the Home.

Class 2 – Practicality and Simplicity

Learn

In this second class, you’re going to explore strategic approaches towards food that can take the place of the bad habits explored previously.

These approaches are familiar and have been mentioned before, they’re practicality and simplicity. These are strategies I have personally applied and have seen great results from.

Simple Food

If you eat simple, healthy meals, you’ll need fewer ingredients and therefore will be spending less.

However, in a culture heavily saturated in luxury and indulgence, returning to a practical and simplistic view towards food can be harder than you think.

The reason for examining Mary in the Case Study from Class 3 of Module 1 Foundations was to highlight how attitudes and spending on food has changed in modern times and how this impacts your finances.

Mary viewed food practically and simply. What does this mean?

Mary lived during a time when foreign food imports were rare and expensive, and the typical Irish person relied on local, seasonal produce to live.

This limited the typical homemaker in what could be made and eaten on a day-to-day basis and created a culture of eating food that was practical for their needs.

In many ways, we can be thankful we didn’t live in this time because it was so restrictive.

However, if you want to really save money through food and think wisely about how you use that food, you must be open to learning about more affordable ways of living and using food, and in this case, the simplistic approach towards food from the recent past can teach modern budget-conscious homemakers some valuable lessons.

Practical Food

So what does it mean to develop a practical and simplistic approach towards food?

It simply means eating nutritious food that is ideally local and seasonal and meals that require few ingredients.

This is affordable food that will maximise your energy and is quick and easy to prepare.

It also means balancing the modern obsession with amazing flavours with the traditional idea that food has a function, which is simply to nourish and fill you, in your daily meals.

In our day and age, we’re used to food that over stimulates our taste buds so that we no longer appreciate the simple, delicious flavours that are provided naturally in food.

Fancy food is fine now and again, but try to appreciate food for what it is and you’ll be content and will save money.

The key to truly embracing practical, simple food is to simply enjoy food and be content.

Benefits of Eating Practically and Simply

Eating practically and simply doesn’t just impact your finances. If you’re choosing the right product, it can greatly improve your health.

Planning a set budget with simple food forces you to be intentional with what you buy, and these helpful limitations force you to eat better. You simply don’t buy the wrong types of food because you can’t afford them in your budget or plan ahead to buy certain foods as rare treats or for special occasions.

Using these limitations to eat simply yet healthily will give you the energy you need to optimise your home, stay motivated and achieve your goals.

Eating better will also greatly impact your emotional energy and stability, helping you feel good about sticking to your budget.

Make the choice now to use your food budget to eat better and you’ll see the difference.

Branding

Be mindful of clever food marketing.

A lot of money and research goes behind food advertisements, and its main marketing tool is to use your emotional attachment to food.

We all have branded food items that we love. Through manipulative marketing, often we only associate branded items with quality.

Confront your habit of only buying the branded version of certain items. Familiarise yourself with reading ingredients on items and compare them to cheaper or supermarket own-brand items, or challenge yourself to make them from scratch.

Clever and Committed Planning

Make sure you know what food you want to get from where. Spend more time planning and less time shopping, and you’ll be less tempted to impulse buy.

I can collect and buy a whole 7+ day shop for my family in 15 minutes or less in a huge supermarket- with a toddler and while being pregnant- because I’ve familiarised myself with what deals there are, what I need to buy, and the exact location of items in the store. This is a strategy that you will explore later.

Plan rewards. While we’re trying to show how simple things are delicious, it’s good for morale to include some affordable, planned treats.

The key to this, however, is in the planning.

Plan one day of the month or eat out or get takeaway, or whatever your preferred treat is, and commit to it. You’ll feel less tempted to buy takeaway or eat out on any other day of the week once it is scheduled and budgeted into your plan.

Or use it as a general replacement day if there’s a birthday or anniversary that month or any other special occasion.

Limiting yourself and saving up for your planned treat will intensify enjoyment and will take away the guilt of feeling like you’re overspending.

Think

- Are you willing to simplify your meals and snacks in order to save money?

- Do you find you have an emotional attachment to food or have an unhealthy obsession with branded food items?

- Have you failed to plan for your weekly food shopping in the past?

- How can you cleverly incorporate some loved meals or treats that are expensive without breaking the bank?

Do

- List the food-related activities (take-away, restaurants, cafe etc) you do on a monthly basis.

- Now estimate the cost of doing these activities every month.

- Plan one day in the month to have a treat (take-away, cafe, restaurant etc) and commit to it.

- Review the three favourite meals that you listed here. Now see if you can simplify these meals. Consider replacing them if you cannot.

Class 3 – Purposeful Spending

Learn

Purposeful spending is the idea that you only spend your money on pre-planned items that have a direct purpose, or ideally multiple purposes, in your home.

In this case, we’re talking about all the food items you’re bringing into your kitchen and how every item needs to be pre-planned and have an intended use.

Commit to purposeful spending and you will immediately see more money in the bank.

So how do you buy food items purposefully?

Meal Planning

The best thing to do is to create a repertoire of meals or a meal plan based on several factors, such as:

- Family favourites

- Seasonal and local produce

- Most affordable produce

- Quickest, easiest and healthiest to prepare

- Good for bulk cooking

There are times when you might be really desperate for a particular meal like, for example, a stir fry that is outside one or several of these factors. Don’t feel like you entirely have to be deprived of certain meals.

You can implement good food management practises in this case through:

- Planning the stir fry around seasonal and affordable produce and

- Forming your meal plan for the week around the special ingredients you bought especially for that stir fry.

Therefore, the soy sauce and fish sauce become purposeful items that you intend to use up, rather than sit in your cupboard only to use once in a blue moon, if ever again.

Single-Use Items

In our abundant Western culture, our cupboards are full of single-use items that were bought spontaneously or for only one or two meals and they weren’t used again and are thrown out.

I’ll go into more detail on single-use items in the third Module Practical Steps.

This doesn’t mean you must use up every single item purchased immediately and never have a planned stock of food in your cupboard like herbs, spices and condiments, or other necessities.

You simply need to stock up strategically and purposefully.

Stocking Up

Homemakers want to be prepared for the unexpected, and because of that, we tend to have a “stocking up” mentality.

We think this ultimately saves us money and time in the long run, and want to have things on hand just in case we need them. This can be wise.

However, most of the items typically on hand in modern cupboards are bought unintentionally and without a specific purpose.

Growing a healthy stock of food items is a good thing, but they must be purposeful items that you use regularly and plan to eventually use up before the use-by date.

Remember, real change with our budgets happens with the little things.

For example, it is wise to stock up on certain items like flour and spices for the autumn and winter for when they’ll be needed for seasonal cooking and baking. However, you must then be intentional in planning to use these items.

Aim for everything in your cupboards to have a known and planned purpose, even if it is not for immediate consumption. This is something you’ll find help in carrying out in the third Module Practical Steps.

Inventory

Later in the third Module Practical Steps, you’ll also explore the importance of keeping an inventory of your food stock as a business does.

Train yourself to know what you need, keep a record of it so you won’t forget and then plan to use those items. It’s a very simple concept.

Through keeping a simple, organised record of what you have you’re preventing food waste, unnecessary repurchases and overspending on food through using what you have, therefore saving money.

Expense That’s Worth It

Having a planned, purposeful food budget doesn’t mean that you eat cheap, poor quality food.

Simplifying your meals and grocery list and developing a purposeful mindset towards spending can allow you to spend more money on some food items that are worth it.

There are many expensive food items that are worth the purchase because of their nutritional benefits, quality and/or quantity.

You can easily fit them into your budget through planning to buy the items once or twice a month and planning how you intend to use them up intentionally in a way that stretches your other ingredients over the month.

For example, I will budget once out of the month to buy a couple of kilos of organic Einkorn Flour and incorporate it into my meal plan for the month in the form of pancakes and bread, and buy several jars of local Raw Honey over the month also.

While these items are pricey, I use them optimally through careful planning.

This way, you can make healthy and worthwhile improvements to your health and food budget without sacrificing your savings plan.

Emotional Spending

I like nice things just like the next homemaker. I especially enjoy eating nice things. In my early marriage, I wasted a lot of money on spontaneous and emotional spending.

I used to love buying valuable things in charity shops because it made me feel good. I used the fact that they were cheap to justify my impulsive spending urges.

But remember, the little expenses all add up.

99.9% of those items I spent money on are gone now because they were not planned and had no purpose. However, I’ve learned from my mistakes and I want you to learn from them too.

I now intentionally practise good spending habits through a commitment to spending purposefully with my financial goals in mind.

Try to exercise self-control in your spending.

If you’ve encountered something while out shopping that you really want but don’t need, analyse it and ask yourself “is this really worth the money?”. This can frame the importance of possessing it.

If you still are tempted, walk away and give yourself ten minutes. More often than not, the urge to buy will pass.

Keep your clearly articulated goals at the forefront of your mind to guide you in times of temptation.

Think

- Do you know what’s in your cupboards, the number of items and when they’ll run out?

- If you were being honest, are you really using that stock?

- Are you stocking up on the right things?

- What are some expensive food items you think are worth the purchase? How often do you need to buy them, and how can they fit affordably into your monthly budget?

- Do you have an emotional connection to spending money? Does spending money make you feel better? If so, do you think this is a good thing?

- How do you think you could deal with the temptation to buy something that’s unplanned, expensive and something that you don’t need?

Do

- List the supermarkets that have the best value for money.

- Now see if these local supermarkets have apps where you can get coupons and vouchers.

- List any deals in local shops that sell local produce.

- List any deals at your farmer’s market.

Module 3: Practical Steps

Now that the foundation has been laid for better spending habits and solutions have been explored for saving and budgeting effectively, you’re now going to start implementing some practical steps that you can apply to your unique situation to save you money.

This Module will take you to your own kitchen where you’re going to prime it for your new money-saving habits. Be prepared to dive into your fridge, freezer and cupboards in order to tackle what’s inside and take those practical steps to change.

Class 1 – Single-Use Items

Learn

In the class on Purposeful Spending from our second Module Solutions and throughout the guide it has been mentioned how cupboards in our abundant Western culture are cluttered with purposeless single-use items. So, what exactly are single-use items and how are they affecting your finances?

Single-Use Items

Single-use items are food products that were bought spontaneously with no meaningful intended purpose, or products bought for only one meal and weren’t intentionally used again.

Single-use items are examples of wasted finances sitting in your pantry because that money you spent is just sitting there gathering dust until it passes its use-by-date or is eventually thrown out.

Now that you’re spending purposefully, however, every item from now on in your cupboard is intentional and will be planned to be used up.

To reiterate, there is nothing wrong with buying items that you hope to use for a specific recipe.

The key is to plan to use it soon and add it to your inventory and plan some meals for the new future that incorporates that item. You’ll learn about keeping an inventory later in this Module.

Think

- Is the idea of having only purposeful, planned food items in your kitchen new to you?

- Have you ever thought about how buying single-use items waste your money?

Do

- Take out all of the purposeless or unused items in your fridge, freezer and pantry and examine them to see if you are going to use them again.

- Work out how much money you approximately spent on these items.

- Separate all items past their use by date to be thrown out. Note how much porduct was used in these items then categorise them into the amounts of waste; high waste, medium waste and low waste. Items that contain a high or medium amount of waste resolve to never buy again. The low items purchase in the future very intentionally.

- With the remaining items seriously consider whether you’ll be able to use those items again. Some could be incorporated into a meal plan to use immediately or within the next few weeks. If you don’t really think you’re going to use an item, donate or get rid of it. Don’t allow it to clutter your pantry.

- Now that you’ve cleared ot and organised your single-use items, completely declutter your fridge, pantry and freezer and clean them while you’re there.

Class 2 – Optimise Your Pantry

Learn

Once the single-use items in your cupboard have been organised and you’ve planned what to do with every item, you have laid the groundwork for optimising your pantry, fridge and freezer that is going to save you money.

How could you be losing money through having a disorganised pantry, fridge and freezer?

If you have a disorganised kitchen you are less likely to see what you have on hand and are more likely to waste food or repurchase what you already have, and it is a very real problem in the modern kitchen.

Organise your pantry and fridge in a simple, logical way with as many items to the front as possible so you can see what you have.

If your pantry is cluttered and messy and you can’t see what you have, this will lead to food waste and overspending.

Seeing your stock is vital, as is organising your stock so that it’s easily accessible. If your food storage areas are organised in a way that your food is clearly visible and you access them quickly, you’re more likely to use all the items, which maximises your stock and your money. Therefore, the best way to organise your fridge, freezer and pantry is to maximise visibility and accessibility.

My Tray System

The Tray System, that I developed, is a simple and affordable way to organise your pantry and fridge that groups all of your food items logically on trays on your shelves so that all of your items are instantly visible and accessible, saving you time and money.

This system also optimises your time in updating your inventory and compiling your meal plan as your items are organised logically and are stored in such a way that everything is visible.

One way to ensure visibility is through using clear containers- this way, you can clearly see what the item is and how much of it is left. This saves you time when updating your inventory, compiling shopping lists and meal plans, and when you’re cooking.

Think through how you can affordably find clear plastic or glass containers. You might be able to reuse glass containers such as large jars, ask friends or family, or find some discounted at a local homeware shop.

For the trays, these can be repurposed or cheaply bought also. Again, clear trays are ideal for visibility. Find trays that will fit your shelves. If you have deep shelves, you can still use the Tray System in a way that will make items to the back easily accessible.

Be selective with how many trays you use and with what shelves you put them on. Not all areas of your pantry or fridge will need them. Focus using them mostly with lots of smaller items or on shelves that tend to gather a lot of clutter.

Your items should be clearly visible and easily accessible, even items towards the back. To access the item you want, you simply pull out the tray and take the item.

This saves you time rummaging through items and prevents items falling to the back of the pantry or fridge, becoming inaccessible or increasing the likelihood of you forgetting about those items, making you more prone to using your stock in a way that is getting value for your money.

If you have deep shelves, consider placing one tray to the back and another to the front. Store more frequently used items to the front, and store as many food items as possible in clear containers. To access items from the back, simply slide or remove the tray to the front and take out the back tray. This is a quick and easy storage solution to suit virtually any pantry or fridge.

However, firstly be sure that you have had:

- Single-use items sorted through and organised

- Decluttered old produce

- Cleaned all of your shelves

- Food stored in such a way that you can instantly see what it is and how much of the product is available (eg. clear jars, plastic containers, etc.)

Think

- How do you think having an organised kitchen can positively affect the rest of your household responsibilities?

- How do you think having an organised kitchen can optimise mealtime?

- Do you find you waste time searching through your pantry and fridge looking for items? Do food items often find their way to the back of the shelves, becoming inaccessible or forgotten about?

- Do you or any friends or family have jars, vases or clear containers in the house that you could clean and repurpose and use to store your food items?

Do

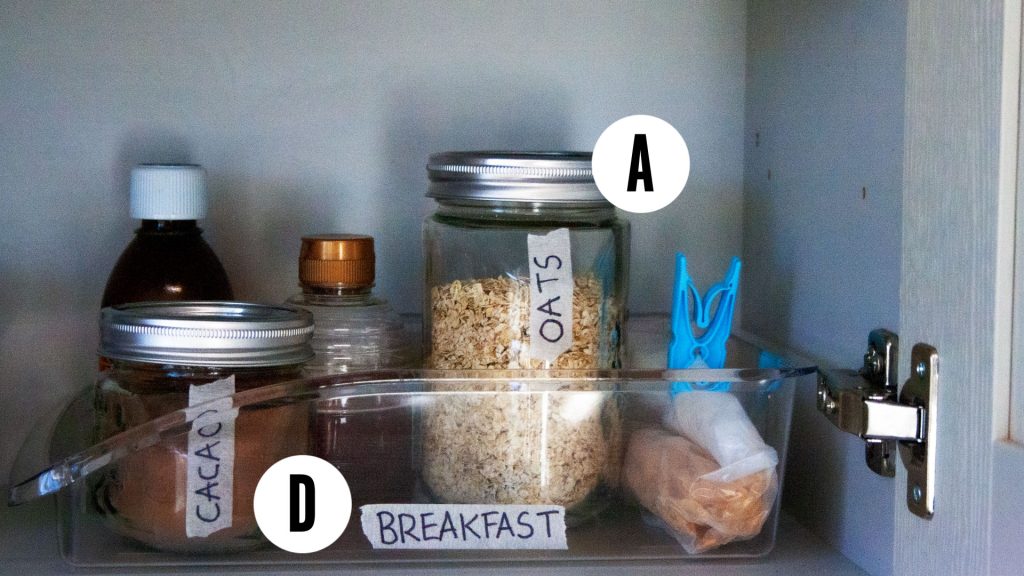

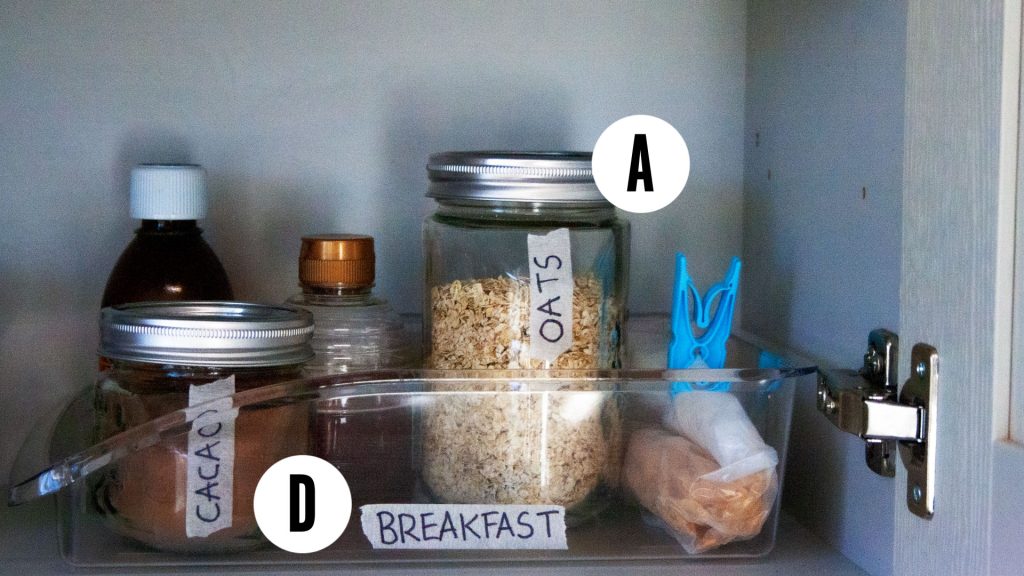

- Store your food items in clear containers, ideally having tall containers for bulk items like dried beans, lentils, rice, pasta and oats (see A below).

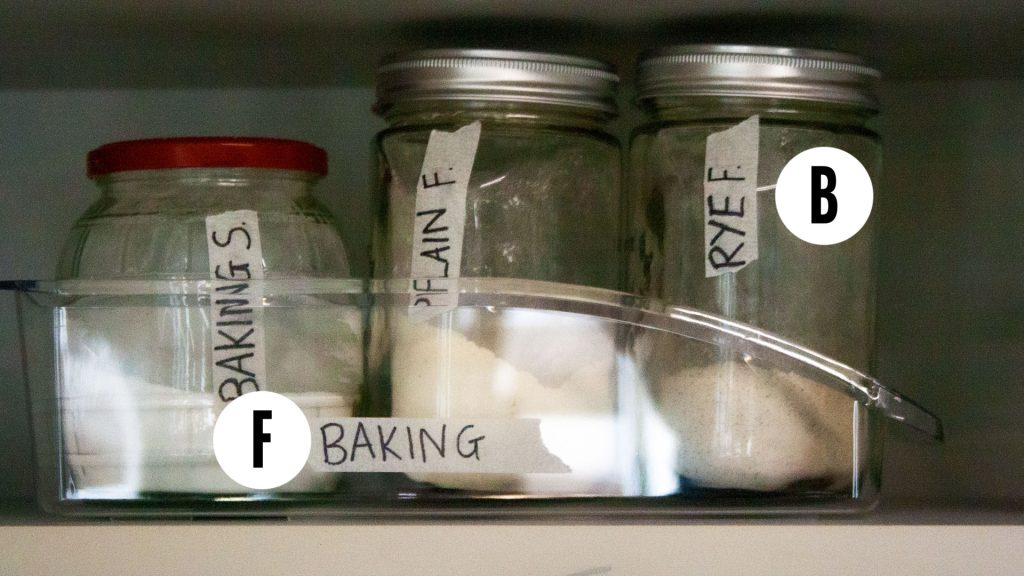

2. Using painter’s tape or masking tape, label all necessary food items. This might be more beneficial for others in your household who may not be as familiar with the food items as you are (see B below).

3. Plan a section in your pantry where you can keep bulk items to refill containers with, eg. on the very top shelf (see C below).

4. Group your items in a way that seems logical to you and in a way where you will know where everything is. For example, group all of your breakfast items together (See D below).

5. Fill your trays with your grouped food items. Place the trays with the frequently used items (like breakfast items) closest to the front (see E above).

6. Now label your trays that have been grouped together in a particular category (eg. “Breakfast” or “Herbs and Spices”). This will be beneficial for others in your household and will train them to put the items back in the right place (see F above).

Class 3 – Inventory

Learn

Finding success in food budgeting and money-saving is through viewing your household like a business.

Have you ever wanted to be a business owner? It takes a lot of organisation and good management, which includes having an inventory.

The Importance of an Inventory

All good businesses have their inventory of stock well under control, much like how they handle their financial department.

The stock of a business is what the business spent money on to manufacturer and it is also what the business needs to sell in order to break even and then make profits.

Stock takes are done regularly, and referring to their inventory is integral to running their business every day.

Imagine the chaos of a business that didn’t have an inventory or do stock takes?

For an organised kitchen that will lead to better spending and saving habits, you need the same commitment to good organisation and management over your stock.

Having an organised inventory of your food stock to refer to helps you quickly see what you do and don’t need to buy and what you have left to cook with.

Use your Inventory when compiling your grocery list and meal plan. It is incredibly beneficial to use up what you already have which minimises food waste and repurchases.

Keeping an inventory for your food will make a world of difference to your finances and to the management of your home, and you’ll feel like you’re doing a good job.

Think

- Imagine a scenario where a business that sells physical items and never took a record of their stock.

- Without doing stock takes, how well could a business serve its customers? How can it make its money back, or make profits?

- How do you think your household will profit from managing your food stock well?

Do

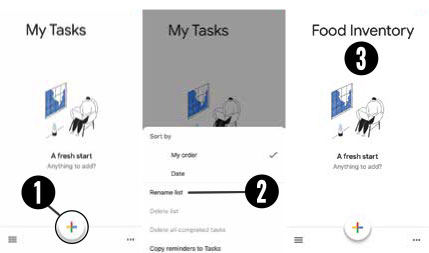

- Download Google Tasks (or a similar app). Google tasks is a free app that can be used on both Android and iOS devices. Google tasks can be used for your grocery lists, meal plans, cleaning routines etc. See Appendix 2 for more details.

- Rename “My Tasks” to “Food Inventory”. Tap the three dots on the bottom right to rename the list. The burger menu (three lines) on the bottom left can be used to create a new list. Having everything labeled and organised in one app will improve your productivity.

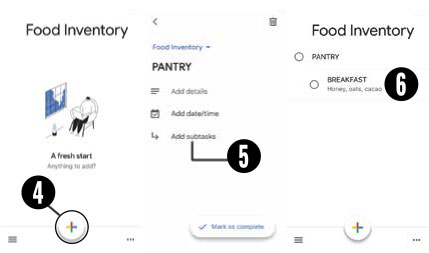

3. Create categories & subcategories. Tap the “+” symbol to create a category for your inventory. Create four categories called Pantry, Fridge, Freezer and Other. Then within each category tap “add subtasks” to create subcategories. Your items in your inventory will go into these subcategories. Under Pantry create the following subcategories: “Breakfast”, “Carbs”, “Fruit and Veg”, “Condiments”, “Dried Herbs and Spices”, “Dried” and “Other”. For Fridge create “Dairy/Poultry”, “Veg”, “Leftovers”, “Meat”, “Other”. Under Freezer put “Meat”, “Fruit & Veg”, “Other”. In Other create subcategories of “Cleaning Products” and “Med/Vit”.

4. Add your inventory into the subcategories placing an “L” next to items that are low in stock. This “L” is a symbol representing “Low”. At a quick glance you can see what you have in stock and what is low.

5. How to use your inventory. Take note of food items that are low as you use them. Schedule a quick stock check before each food shop. Set a timer for 10 minutes and get it done as quickly as possible. Mark items that are low with an “L” so you know to repurchase these in your next food shop. Consult your inventory to compile your grocery list and meal plans.

Class 4 – Strategise Like a Pro

Learn

Now that you have decluttered, organised your food stock and categorised your items in your Inventory, your kitchen is optimised and primed to save money.

Over this guide, you’ve encountered helpful tips for you to plan to save money on food.

Read over the recap below to finalise your money-saving shopping and budgeting strategy.

Shopping Strategy Recap

Food shopping that saves you money requires an organised, thought out plan for how, where and when you shop.

Planning a good shopping strategy will require research. Find out what time is best to shop at. Timing when to shop is important so you know when shelves are restocked and queues for checkout are shorter.

Read through your junk mail for vouchers, think through what local shops sell what.

Check out when your next local farmer’s market is, and check online for deals from your local big supermarkets.

Think through healthy, affordable meals that your family enjoys. This will dictate what items you buy.

When planning your grocery shop, refer to your meal plan and up-to-date inventory so you know exactly what to get.

Many of these tips you will read below may seem inconvenient or like a lot of work, but the reality is that clever planning and research is needed so you’re confident you’re getting the best deal.

Think

- Are you willing to inconvenience yourself for a short time to save money in the long run?

- What other clever ways could you save money on food in your locality?

Do

- Review your goals. What are the reasons behind forming a food budgeting strategy?

- Determine where you are going to shop.

- Make a strategic decision to shop when the store is quiet. This will reduce the time needed in the store as you swiftly move from aisle to aisle easily. Experiment with a time that works best for you.

- Review your inventory in Google Tasks and craft a grocery list that will replenish items in low supply and meet your specific planned meal requirements.

- Draw a map of the floorplan of the supermarket you are going to shop at while noting where regular purchase items are kept.

- Use the map you have drawn to plan the most efficient shopping route around the store.

- Now order your shopping list in accordance with this route.

- Review your shopping list to see if there are any items that are worth buying in bulk from another distributor.

Module 4: Build Your Food Budget

Class 1 – Building Your Budget

Learn

In Module 1, Class 1, you examined the importance of treating your home like a business by subtracting your outgoings from your income and calculating your total household profits. The best way to divide your household’s profits, which you have calculated, is to divide it into three main sections: savings, food budget and expendable income.

The amount you allocate to each section is completely subjective to the income you earn, the cost of food in your locality, the number of people within your household and how much you want to prioritise saving towards your financial goals.

However, you should prioritise savings as much as possible, keep your food budget as low as is reasonable, and be intentional with your expendable income purchases. This would mean investing most of your profits into your savings and budgeting for a modest food budget and expendable income allowance.

As an example, imagine you have a family of four and have prioritised saving money towards your financial goals. This would dictate that your budget will be as intentional and as small as possible. Follow the principles below to see how you could compile your Food Budget in this instance, and customise it to your unique situation.

Savings

Savings are incredibly important for every family and individual. Not only should you intentionally put a set amount of money aside towards your financial goals and your future, but you should also prioritise setting aside money for emergencies or difficult circumstances that are almost certainly guaranteed to arise at some point in your life.

Savings should be split into four main sections:

- Emergency Fund – This is the priority fund of a cap of 1000-2000 that is never touched and is reserved for emergencies only- eg. Hospital. It is a necessary safety blanket for your family that you can access only when needed.

- 6 Months Expenses Fund – This is a fund that saves 6 months of household expenses in case of job loss or for other needs that don’t qualify as an emergency, eg. washing machine or the car breaks down.

- Savings Fund – This fund is to save for future goals. Once you have the priorities of your Emergency Fund and 6 Month’s Expenses Fund saved, you should then heavily invest your savings into this fund.

- Bills and Utilities – Save some money after each paycheck into this account to save towards your necessary expenses and utilities.

Food Budgeting

Much like your savings, the amount you allocate to your food budget is completely subjective to your unique family situation.

Do know, however, that while the budget suggestions may sound limiting, it is entirely possible for a family to live on a modest food budget and eat very well with a clever strategy, careful planning and purposeful spending with their financial goals in mind.

Follow the below principles for how to budget for a family of four as a helpful guide:

How Much To Budget?

Your food shop should start at around $100 per head starting with three people. This means that for three people, their monthly food budget should be $300. However, $300 is also the recommended budget for two people as when considering factors such as product amounts and prices, $200 in most circumstances is too little to live on for two people.

Add an additional $100 per month per person and divide this by 4 to get your weekly grocery budget.

For a family of 4, this means their weekly budget is a maximum of $100.

Ideally, this family should budget to spend at most $90 each week or even less if possible, only allowing themselves to spend $100 once or twice a fortnight to buy more infrequently used or bulk items like washing detergent or bulk nappies, etc.

If you are struggling to keep within your budget, review your finances and your expendable income allowance and see what food budget best suits your family while saving towards your goals.

You may be able to increase your budget by decreasing your expendable income allowance in this instance without taking from your savings.

For occasions like Christmas, birthdays or anniversaries, plan to save for the extra expense in the weeks and months beforehand and stick to a budget, or you can use an extra budgeted amount from your expendable income for these rare occasions.

Through applying the tips you’ve found throughout this guide, it is entirely possible to keep within this tight budget because I’ve done it.

There may be exceptional circumstances such as illness or a special need that may need to be accommodated for, however, your food budget can be customised to meet these needs.

Expendable Income

Expendable income is any remaining amount of money after paying for your prioritised expenses like rent/mortgage and bills, saving in your multiple savings accounts, and after your carefully planned food budget.

If you’re serious about reaching your financial goals, you must examine your attitude towards expendable income and use it wisely.

Expendable income is an opportunity for you to save more money and reach your financial goals quicker. However, it can also serve your family well.

Pre-plan and limit your expendable income. Remember your commitment to purposeful spending? Every item you purchase needs to be planned and have an intended use, including your leftover income.

Keep an eye on your calendar for what your expendable income can be saved for. Is it for your once-a-month takeaway treat, or is there a birthday or anniversary you’ll be celebrating one month?

Luxury items like clothes should be planned also. Take advantage of gift-giving occasions like birthdays, anniversaries or Christmas and ask for vouchers so you can spend them on things you want that are not immediate necessities.

However, it might be more valuable to you to use your expendable income allowance for some planned dates or family outings during the month.

Make your allowance stretch by looking for the best local deals, or plan bigger trips like going to the zoo or a waterpark well in advance.

Remember that memories and experiences are far more valuable than objects, and to create those you may not even need to spend a dime. Prioritise spending quality time with your family and/or spouse and enjoying them, and you won’t miss out on not having a lot of extra money to spend.

Remember your financial goals and what you ultimately hope to achieve through your budgeting. Reaching your goals ultimately, in the long run, will be worth the sacrifice in the meantime.

Think

While crafting your food budget, refer to your answers under Strategise Like a Pro to help you.

Do

- Note your household profits that you have defined earlier

- Split this amount appropriately between three categories: Food Budget, Savings Budget and Expendable Income.

- Food Budget – Using the suggested amounts below to determine your monthly food budget:

– 1 Person ($100)

– 2 People ($300)

– 3 People ($300)

– 4 People ($400)

– 5 People ($500)

– 6 People ($600)

– etc. - Divide your Food Budget by four to determine your weekly allowance. Do not exceed your weekly budget allowance when doing your grocery shopping.

- Now subtract your monthly Food Budget from your monthly household profits. This is the amount you have for your Savings and Expendable Income Budget.

- Savings Budget

– Allocate a weekly/monthly amount into your $2000 Emergency Fund.

– View your monthly outgoings and multiply them by 6. This is the amount needed for your 6 Months Expenses Fund. Now Allocated an amount towards this 6 Months Expenses Fund.

– View your 6-month goals. List the amount needed to achieve these goals and then allocate a weekly/monthly amount towards your 6-Month Goal Fund. - Finally, subtract your montly savings budget from your monthly household profits after groceries and savings. This is the amount you have for your Expendable Income Budget.

- With your remaining finances after accounting for your groceries and savings, allocate an amount to achieve your monthly treat. This is your Monthly Treat Fund.

Well Done!

Having finished building your budget, you are now set to save money through effective food budgeting.

Continue your learning by getting involved in the comments below! You will be supported and will meet like-minded people who are on the same mission as you.

If you found this guide valuable, chances are that your friends and family will too. Please consider encouraging someone who could benefit from this course to complete it by directing them here.

Food Budgeting Appendices

Appendix 1 – Online Grocery Shopping

Perhaps you have the option of doing either online grocery shopping or in-store grocery shopping. Which should you choose?

Here are the pros and cons of both types of shopping from my experience:

In-Store Pros

Fresh Produce

- You can see the fresh produce for yourself and handpick what you’d like.

- Sometimes you might encounter a reduction that hasn’t been included online.

- A good tip for picking up fresh produce is to always check the dates and choose items from the back of the shelf. Supermarkets will display the freshest produce at the back because they want their customers to buy the older produce to the front so they won’t lose money.

Reduced section

- The reduced sections in supermarkets can be used to save more money in your food budget.

- While most of the products will not be worth the expense through over-ripeness, you might get the occasional bargain with some perfectly ripe fruit or vegetables that were planned for immediate consumption.

In-Store Cons

Time-Consuming

- Scheduling in a trip to the local supermarket once or several times a month might be inconvenient, especially during busy seasons like during pregnancy or caring for small children.

- Finding your products in-store can also be time-consuming and increase the likelihood of impulse buying. (However, if you follow the shopping route that you planned you will optimise your in-store grocery shopping despite the cons.)

Online Pros

Convenience

- Doing all of your shopping from home and having it delivered or picking it up already picked can be hugely convenient, especially during the busier seasons of life.

Fewer Impulse Buys

- It can be easier to ignore the so-called “deals” that are offered on the front page to get you to impulsively part with your money, making it more likely you’ll stick to your budget. (However, it is still possible to stray from your budget when online shopping.)

Online Cons

Old Produce

- With online grocery shopping, you can’t handpick the freshest produce.

- Most often you’ll be delivered old produce that is expiring soon so the supermarket won’t lose money.

- You also can’t access the same reduced bargains as you can in-store, or at least it would be a risk if you could as you cannot see the produce.

Delivery Expense

- Finding a convenient time to have your online shopping delivered to you can be difficult, and the most convenient time slots are usually the most expensive.

- The cheapest delivery times are usually inconvenient and unsociable times and might still be expensive.

Lack of Size Comparison

- While often measurements are provided for products online, sometimes no amount is given or size comparison provided, so this makes it difficult to know if you are getting the best value for your money.

Appendix 2 – Google Tasks

Much like running a successful business, the key to staying productive and optimising your home is to eliminate as many unnecessary steps as possible in order to get your result fast.

That’s why I use Google Tasks on my smartphone to optimise my productivity.

Keeping a record of everything you need doesn’t need to be complicated.

From to-do lists to cleaning schedules and routines, or grocery lists, expenses list, budgets and meal planners, it couldn’t be more convenient for the modern homemaker to have everything you need on the one free and easy-to-use app.

There are many other things you can use Google Tasks for, however, in Mastering the Home:

Organised and Convenient

Your time as a homemaker is valuable.

Keeping multiple planners, to-do-lists and schedules to organise and keep track of can be a chore, and you are less likely to stick with them if they are not easily accessible or convenient to use.

Eliminate all unnecessary steps and keep everything you need together on the one app Google Tasks on your smartphone.

This is most efficient as most homemakers have a smartphone that they will always have nearby and will definitely use multiple times a day.

Make a habit during some scheduled screen time to consult your Tasks for the day so you can run your household in a way that saves time and money.

Google Tasks can be used across multiple devices and can be synchronised with different Google accounts, so your spouse can log into your account easily to access all your homemaking lists, schedules, budgets and to-do-lists when necessary too.

Google Tasks Uses

Google Tasks can be used for many things, including:

- Grocery Lists

- Meal Plans

- Food Budgets

- Inventory

- Cleaning Routines

- To-Do-Lists

- Schedules

- Record for Expenses

- Google Tasks Tips

- Schedule Your Screen Time

Since your time as a homemaker is valuable, you don’t want more temptation to be on your smartphone for more time than you should be.

Schedule and plan your screen time for the day.

Set an alarm or use the Screen Time feature on iOS to allow yourself several short blocks of 5 or 10 minutes of screen time throughout the day to do something productive- update your inventory, compile your grocery list, consult your cleaning routine, check emails and messages- so that you’re wasting less time and are staying organised.

Optimise Google Tasks

Use the same method presented in this guide to create your grocery lists and cleaning schedules. You can arrange the items on your list easily according to how you need them or how you’ll encounter them, for example, on your fast shopping route through your supermarket, or for your morning cleaning routine.

Tasks can be ticked off and are saved so you can untick them so it is easy and quick to use, especially for updating your inventory or doing your shopping list. Simply untick old items that you expect to use again.